Competitor analysis guide for GTM teams

Updated December 27th, 2025.

Competitor analysis isn’t just a one-off exercise, it’s a strategic growth tool.

Whether you’re entering a new market, refining your positioning, or scaling your go-to-market strategy, understanding your competitive landscape gives you an edge across product, marketing, sales, and customer success.

In this how-to guide, we break down how GTM teams can conduct data-driven competitor analysis to sharpen positioning, uncover growth opportunities, and make smarter, faster decisions.

👉 Read also:

Check out also our latest blog post on competitor analysis agents.

Why competitor research matters

Gain a competitive edge:

Differentiate your business and sharpen your USP

Stay on top of emerging trends or shifts in the market

Identify opportunities:

Spot gaps in the market that your competitors are missing and areas for potential growth

Better strategic planning and decision-making:

Align product, pricing, and messaging based on real-world market data

Understand the landscape:

Know who’s gaining traction and why

Gain a clear picture of the competitive environment and potential threats

Benchmark performance:

Compare your performance against competitors and identify areas for improvement

Set realistic, competitive KPIs and evaluate your progress

We’ve broken competitor analysis down into 8 clear steps, from identifying who you're up against to uncovering content gaps, evaluating pricing strategies, and pinpointing your unique edge.

By combining these research methods, you can gain a comprehensive understanding of your competitors' strategies and use this knowledge to refine your sales and marketing strategies, and improve your products or services.

So let’s jump right in:

#1 Identify your competitors

Start with categorising your:

Direct competitors:

Selling similar products/services to the same audience

Monitor their positive or negative performance

Market share

Mergers, acquisitions, or bankruptcies

Offering development

Talent acquisition

Indirect competitors:

Businesses that offer different products or services but still compete for the same customer budget or needs

This helps you understand evolving customer preferences, identify potential threats and opportunities

Emerging competitors and new industry trends:

Startups or innovators gaining traction fast

How are key competitors dealing with the new emerging market or industry trends

How to do it:

Use tools like Crunchbase, G2, Google search, or

AI tools such as GPT-4 with the phrase "alternative to [your brand/product]" to uncover hidden competitors

Read also: Competitor analysis with AI agents

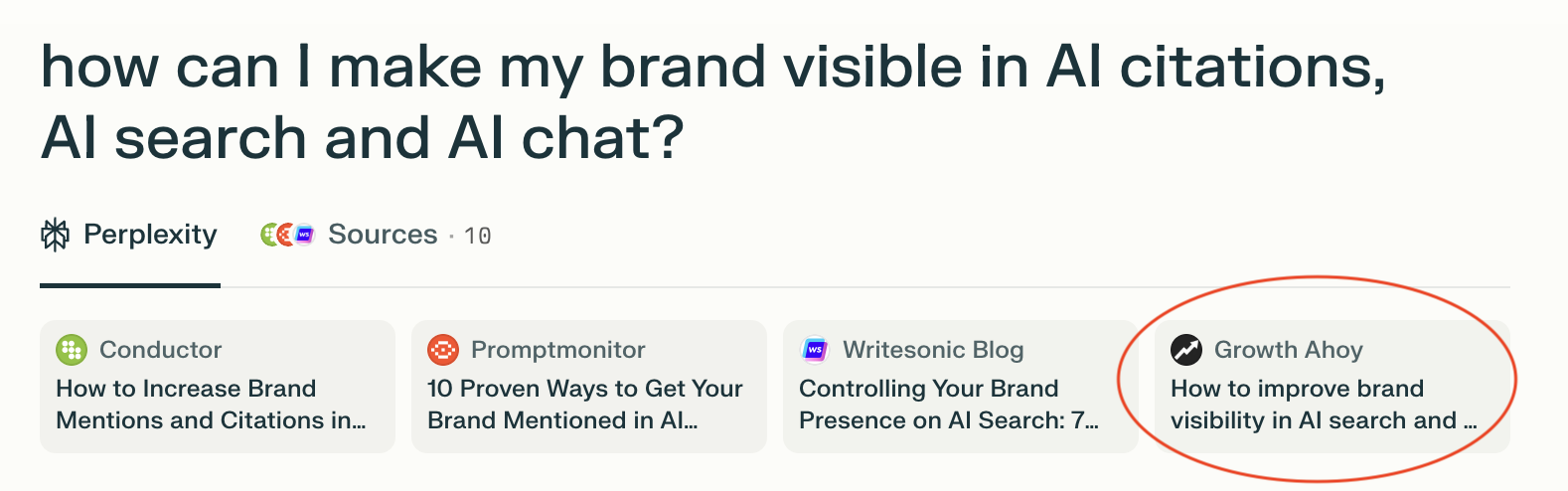

Perplexity just cited Growth Ahoy's blog post AI Brand Visibility - How to optimise brand visibility in AI search and chats.

AI visibility (GEO/AEO)is now one of the most competitive topics online. Yet with the right strategy and tactics, your brand too can still stand out (as we do with this topic), even in a crowded landscape. Let’s ensure that your customers can also find you.

#2 Analyse competitors’ products and services

What products and features do they lead with?

How are they pricing their offer?

What’s their unique value proposition?

How do they frame their competitive edge?

How to do it:

Sales team: Win/Loss analysis:

Win-loss analysis can reveal unmet customer needs and pain points in lost cases, guiding product development and innovation.

Investigate competitors’ product pages, try freemium/demo versions, and compare customer feedback across review platforms such as G2 and Trustpilot.

Compare multiple competitors’ offerings side-by-side to generate a clear differentiation map.

Use AI to assist: AI can help you break down competitor offerings by summarising product pages, feature tables, or marketing copy. You can:

Paste product descriptions and ask AI to extract positioning patterns, key differentiators, or gaps.

Input multiple review snippets from G2 or Trustpilot and prompt AI to categorise common praise and complaints.

Ask it to simulate buyer reasoning: “What would make a VP of Sales choose this product over others?”

These insights help you build clearer comparisons and improve how your own value proposition is messaged in-market.

#3 Assess competitors’ pricing strategy

Pricing has a major influence on buyer perception and positioning:

How are products/services priced compared to yours?

Do they lead with price, value, or results?

How do they justify higher pricing (e.g., outcomes, speed, service, quality)?

Are there tiers, bundles, or usage-based pricing?

Do they offer discounts, free trials, or freemium models?

For e-commerce:

Compare shipping policies and total cost at checkout

Evaluate how promotions or urgency are applied (e.g. timers, stock limits)

For service businesses:

Look at how they position value rather than just price — testimonials, ROI calculators, or customer stories can offer cues

How to do it:

Wayback Machine (to track pricing page changes over time)

BuiltWith to see if pricing tools or quote engines are used on the website

Sales team: Win/Loss analysis:

A win-loss analysis helps determine if pricing was a significant factor in losing deals to competitors

Compare your pricing against competitors, understanding how your pricing strategy stacks up in the market

Use AI to assist: AI can help compare pricing models by simulating buyer decisions and price/value perception. You can:

Paste pricing tables or landing page copy and ask AI to summarise perceived pricing strategy (e.g. cost leadership vs. premium positioning)

Ask AI to generate comparative tables that analyse how multiple competitors tier their offerings

Simulate a pricing decision from the perspective of different buyer personas and prompt AI to explain which pricing structure would appeal most to whom, and why

Use AI to draft messaging that justifies your pricing model relative to competitors’ perceived value.

#4 Understand their sales strategy and channels

Evaluate their sales strategies and channels

Understanding sales strategy may require more digging:

Are they using inbound or outbound tactics?

If product-based: go through the buying journey (e.g. cart experience, upsells, retargeting)

If service-based, sign up for demos or consultations

Monitor lead nurture sequences: what emails do you receive? Is there a follow-up?

Explore sales job descriptions for clues about their sales process and structure (SDR/AE model, territory focus, quotas)

What roles are they hiring for in sales? (LinkedIn Jobs is gold here)

Check for referral, partner, or affiliate programs that expand their reach

Use review platforms (G2, Capterra, Trustpilot) to reverse-engineer buyer expectations and sales interactions

Interview any customers you have won over from the competition

How to do it:

Review job boards, demo their sales experience, or reverse-engineer touchpoints from buyer reviews.

Use AI to assist: AI can help decode a competitor’s sales strategy by simulating their sales funnel or analysing outreach content. You can:

Paste in sales job descriptions or onboarding material and ask AI to map out their sales team structure or go-to-market approach

Simulate a cold outbound email sequence from a buyer’s perspective and ask AI to evaluate tone, clarity, and CTA strength

Identify patterns across reviews or testimonial language that hint at their post-sale engagement style

Compare follow-up email timing, demo flow scripts, or objection handling frameworks to suggest how your process could be refined

#5 Research their customer base

Who are they targeting (industries, roles, company size)?

What pain points are they addressing?

Are there reviews/testimonials that highlight what buyers value most?

How to do it:

Use G2, Capterra, or even case study sections of their websites.

Use AI to assist: AI can help you map competitor customer segments and extract key emotional or value-based insights from customer feedback. You can:

Paste in testimonial content and ask AI to identify which buyer personas are being referenced, and what outcomes they care most about

Cluster different reviews by use case, vertical, or job title to understand who the competitor is resonating with most

Use AI to simulate how a buyer in a given segment might perceive the competitor’s offer, or where they might fall short

Use AI to simulate objections to buying the product and customer pain points

Compare sentiment across competitors to identify positioning whitespace or common frustrations that your messaging can speak to

#6 Evaluate their marketing strategy

6.1. Compare marketing strategies:

How active are they on social media, and which platforms do they use, and how large a following do they have?

How often do they post? What content formats do they prioritise (videos, carousels, long-form posts)?

Do they create and distribute press releases? How often?

Are they running thought leadership content, case studies, webinars, or podcasts?

What role does email marketing play in their funnel?

Do they use gated content like eBooks or guides?

Do they focus more on digital or offline marketing?

What messages are they consistently pushing?

How do they build awareness and trust?

How to do it:

Meta Ads Library, LinkedIn Ads, SparkToro (for content frequency and audience targeting)

BuiltWith (to identify marketing tech stacks used by competitors)

Use AI to assist: AI can speed up your marketing intelligence significantly:

Copy-paste email sequences, ad copy, or social posts to ask AI for tone, theme, and positioning analysis

Upload landing page copy and prompt AI to reverse-engineer the messaging strategy, funnel intent, and target persona

Ask AI to generate a comparative table of how several competitors structure their funnels or what types of CTAs they use

Summarise weekly newsletters or blog updates into recurring content pillars

Request campaign idea breakdowns or even simulate how a competitor’s email journey might play out after opt-in

Ask AI for competitor gap analysis

6.2. Assess their website, SEO & GEO

How are their website and pages structured?

How strong is their UX — do they make it easy for visitors to convert or navigate?

What kinds of CTAs do they use?

How are the products featured on their website? How do they address their end customer benefits?

Do they have a pricing page or a product configurator on their site?

Do they make buying easy for their end customers? If so, how?

Do they have case studies and customer testimonials?

Are there topic gaps or outdated sections in their content?

How to use competitor SEO & GEO gaps to inform GTM strategy?

Use the SEO / GEO competitor research tool to identify opportunity gaps:

1) Run a competitor SEO domain analysis in SE Ranking, Semrush, or Ahrefs

Look for topics your competitors rank poorly for: filter for keywords with difficulty <30, search volume >100/mo

What keywords or search queries are they ranking for?

What topics are they building authority around?

Build content around those search terms to steal share of voice

2) In your Google Search Console, identify your long tail queries:

Queries with high impressions but low clicks

These may be signs of weak content for you to optimise or emerging visibility AI summaries

Create targeted content to address those queries better

3) Use AnswerThePublic:

Enter your niche/topic

Export the list of real user questions

Build high-authority content answering each in-depth

Use AI to assist: AI can evaluate UX and content gaps by analysing competitor websites. You can:

Input homepage or landing page copy and ask AI to assess clarity, conversion orientation, and CTA strength

Feed in a sitemap or blog archive and prompt it to identify missing topics or underutilized formats (e.g. no case studies or how-to content)

Ask AI to rewrite or reframe weak competitor messaging to see how you could do better

Compare navigation structures and suggest improvements based on industry best practices

Do prompt analysis to find how your brand vs competitors show up:

Prompt AI with queries your ideal customer would ask.

Does your brand show up?

Do competitor’s show up?

6.3. Monitor social media

Study their tone, engagement style, and interaction with customers.

What themes are they pushing?

Who are they tagging?

What’s resonating?

Which hashtags are they using?

Who are they hiring? Which roles, and for which teams? (early signals of new upcoming launches or offering expansion)

Use AI to assist: AI can analyze the tone, frequency, and messaging of social posts to uncover positioning trends. You can:

Paste LinkedIn, X, or Instagram post text and ask AI to summarise their voice and emotional appeal

Identify trends in hashtags, topics, or posting cadence

Analyse audience engagement and simulate sentiment patterns (e.g. “What do followers tend to like or push back on?”)

These insights can help you position differently and discover whitespace in the competitive conversation.

6.4. Monitor PR and media mentions

Set up regular competitor media monitoring by using tools that track how often competitors are mentioned across news outlets, social media, blogs, and forums.

This includes monitoring customer announcements and feedback to spot trends or shifts in sentiment, helping you to stay informed about competitors' public presence, new accounts and market perception.

What key topics are they trying to own with PR

Which media are publishing their press releases

Do they have spokespersons, if so, what roles

Do they have media appearances

Do they publish research, do guest blogging or publish paid articles

Do they do influencer collaborations

Which new customers have they won over

Have they announced new services, products, locations, or offering targeted to new ICPs?

Have they announced about new hires

#7 Conduct a SWOT analysis

Summarise what you’ve gathered:

Strengths – What do the competitors consistently do well?

Weaknesses – Where are they vulnerable?

Opportunities – What gaps can you exploit?

Threats – Where are the competitors gaining ground?

Bring your GTM, product, and leadership teams together to align on insights. Once you’ve mapped the field, find your lane:

Where do you outperform competitors?

Where can you zig while they zag?

What strengths can you double down on?

How can you frame these as value to buyers?

#8 Keep it fresh: Competitor analysis is never done

Monitor your top 3–5 competitors quarterly (or start using AI agents for real-time monitoring)

Track pricing, positioning, messaging changes etc

Share the key competitor and market insights to your GTM team

Also list strategic implications and action items based on the insights

Regularly refresh your SWOT and keyword opportunity maps

Avoid pitfalls in competitor research

Competitor analysis is a smart move when starting or growing a business—but it’s important to approach it with the right mindset. Here are a couple of common mistakes to watch out for:

Overdoing the research. It’s easy to fall into the trap of endlessly analyzing every potential competitor. But too much research can lead to analysis paralysis—where you're so busy gathering information that you never actually launch your business. Remember to monitor only your top 3–5 competitors.

Assuming competitors always get it right. Just because a competitor is doing something doesn’t mean it’s effective or profitable. Businesses often stick with suboptimal strategies due to habit, resource constraints, or internal pressures. Even if a certain approach works well for them, it might not suit your unique goals or context.